What are the different types of reports that can be exported?

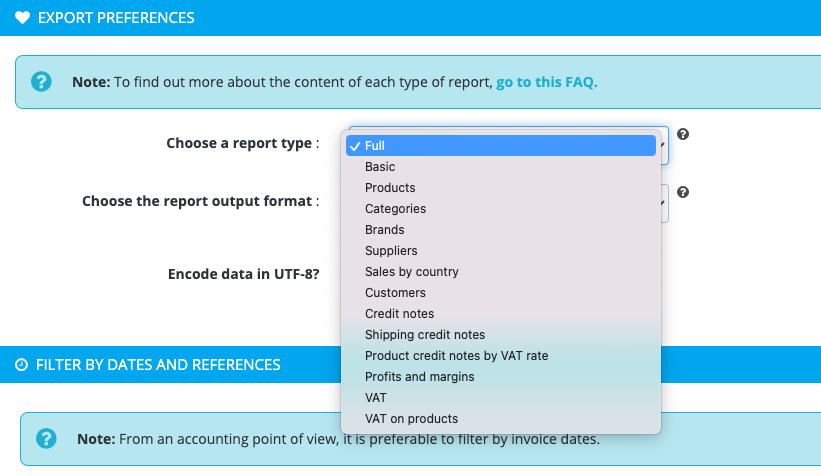

The different types of accounting reports are:

"Full" and "Basic" reports

These 2 types of reports display accounting data for each order placed over the selected period. The full report contains more data (and therefore more columns) than the basic report.

- "Full" report: to know more about the columns of this report, click here.

- "Basic" report: to know more about the columns of this report, click here.

To find out more about how to use them, watch this video (only in french for now).

"Products" report

This report displays the products (or product combinations) purchased during the selected period.

To know more about the columns of the "Products" report, click here.

This report will help you identify what are your best products, how much of the profits represent each product and therefore which products to highlight or promote. To find out more about how to use it, watch this video (only in french for now).

Notes:

- The "Products" report is the only one that can display the results by VAT rate if the filtering option is selected. Since each product is processed separately, it does not require too much server resources to sort by VAT rate.

-

In the case of a multi-currency and multi-country site and of a product report sorted on a given VAT rate: if a product declared, in its product file, as having a tax rate as default was ordered in a VAT-free country, then it may be not exported in the report.

For example :

A 100$ product with a 20% VAT rate declared in its product file. This product has been ordered several times in France (country that applies the VAT rate of 20%) but the last order of this product comes from the USA (country without VAT). Since the MySQL query groups all product orders by product ID and takes into account the localization information of this last order, the product will not be displayed in the product report filtered on a 20% VAT. It is important to understand that this is not a bug of the module and that it comes from the behavior of MySQL towards the data of localization of an order placed on a PrestaShop solution.

"Categories", Brands" and "Suppliers" reports

These 3 types of reports enable you to display the categories (or brands or suppliers) of products that have been ordered over the selected period. So you can see which category (or brand or supplier) is the most popular with your customers, for example.

- "Categories" report: to know more about the columns of this report, click here. To find out more about how to use it, watch this video (only in french for now).

- "Brands" report: to know more about the columns of this report, click here. To find out more about how to use it, watch this video (only in french for now).

- "Suppliers" report: to know more about the columns of this report, click here. To find out more about how to use it, watch this video (only in french for now).

"Sales by country" report

This report displays a list of orders placed in a given country.

To know more about the columns of the "Sales by country" report, click here

Since July 1st 2021, the VAT-e-commerce reform introduces new rules concerning the taxation of products sold remotly on the territory of the European Union. This "sales by country" report can be very useful for your VAT calculations by country. You can easily calculate the exact amount of taxes to pay to the corresponding states.

To find out more about how to use this report, click here.

Important: check that the tax rates applicable in each country are well configured in your PrestaShop, otherwise, you will not have the right amount of tax collected. The module is based on the tax indicated in your PrestaShop, according to the country, at the time of the order. On the other hand, if the previous configuration is correct, the tax rate is the one of the destination country, whatever the amount of orders made in this country.

"Customers" report

This report displays the list of customers who placed orders during the selected period.

To know more about the columns of the "Customers" report, click here.

This report allows you to rapidly see who are your best customers and what proportion of sales they represent for your shop. You can also identify which customers you can reward because they have never received any discount vouchers, for example. To find out more about how to use this report, watch this video (only in french for now).

"Credit notes", "Shipping credit notes" and "Product credit notes by VAT rate" reports

These reports display a list of credit notes generated over the selected period.

- "Credit notes" report: to know more about the columns of this report, click here.

- "Shipping credit notes" report: to know more about the columns of this report, click here.

- "Product credit notes by VAT rate" report: to know more about the columns of this report, click here.

To find out more about how to use the reports of type "credit notes", watch this video (only in french for now).

Note:

Credit notes are calculated by PrestaShop in Mysql tables that are different than the one of the orders. This means that we can’t include the credit notes in "Order" type reports (such as the "Full" and "Basic" reports) and subtract the credit amount to the total order amount so that you can get an accurate accounting view over a given period.

For the period you're interested in, you will have to first export an "Order" type report (such as the "Full" or "Basic" report), at CSV format, and then, for the same period, export a report of type Credit notes (at CSV format). Finally you will have to subtract the amounts in a spreadsheet like Excel for example.

"Profits and margins" report

To know more about the columns of the "Profits and margins" report, click here. To find out more about how to use it, watch this video (only in french for now).

"VAT" and "VAT on products" reports

- "VAT" report: to know more about the columns of this report, click here. To find out more about how to use it, watch this video (only in french for now).

- "VAT on products" report: to know more about the columns of this report, click here. To find out more about how to use it, watch this video (only in french for now).

Important note if you sell products with different VAT rates:

For performance reasons, it's not possible to display the tax collected per order for different VAT rates in the same report because products of a same order may be subjected to different tax rates and the module would have then to inspect each order, which would require a lot of resources to your server. That said, there is a solution to get the tax reported by tax rate, by using the "Products" report. To know it, click here.