What do the columns in the "Profits and margins" report correspond to?

In this FAQ we explain the meaning of each of the columns you'll find in the PROFITS AND MARGINS report. To find out more about how to use the "Profits and margins" report, go to this FAQ (the video is a bit old, so the column labels have changed a bit, but the principle remains the same!).

Name of the shop where the order was placed.

Order identifier.

Date the order was placed by the customer.

Invoice number associated with the order.

Date of invoice generation associated with the order.

Discount total excl. VAT (negative value)

Total amount of discounts applied using voucher code(s) (cart rules).

Please note: this column only calculates discounts resulting from voucher codes (cart rules). Discounts due to specific prices are not taken into account here.

Total VAT on discounts (negative value)

Total VAT associated with the total amount of discounts (cart rules), and which will therefore not be collected and paid to the government.

If you have activated the function enabling you to offer gift wrapping to your customers, this column shows the total amount of the wrapping costs, excluding VAT.

Total VAT collected on wrapping costs.

Sum of the prices of the products included in the order, excluding VAT. If a specific price is applied, it is taken into account. The eco-tax on the products concerned is also taken into account in this sum, excluding VAT.

Sum of VAT collected on products. VAT is calculated on the specific price of the product if a specific price rule was in effect at the time the order was placed. VAT on eco-tax is also added to this sum for the products concerned.

Sum of the amounts corresponding to the eco-tax, for the products concerned, excluding VAT. As a reminder, this sum is already included in Total products excl. VAT. This column is useful for your eco-tax declaration forms.

Sum of VAT collected on eco-tax amounts, for the products concerned. As a reminder, this total VAT on eco-taxes is already included in the Total VAT on products. This column is useful for your VAT and eco-tax declaration forms.

Sum of the cost prices of the products included in the order.

Notes:

- The module allows you to decide whether you want to consider the cost price of the product as it was at the time the order was placed, or whether you want to take the current value of the product's cost price. By default, the cost price is recorded at the time the order is placed, and this is used for the various calculations. If you prefer to use the current cost price, go to the module configuration and uncheck the corresponding option.

- Moreover, when the module retrieves the cost price value, it first looks at the level of the (default) supplier associated with the product (or product combination). If the cost price has been entered at this level, this value will be taken into account; otherwise, the module will look for the cost price value entered in the product's "Pricing" tab.

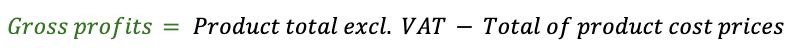

These are profits before discounts (voucher codes) are taken into account:

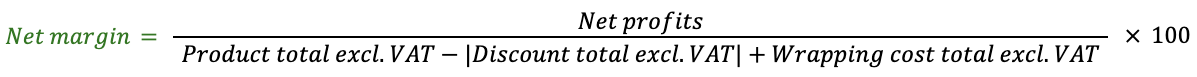

These are the profits received once the total amount of the sale has been taken into account. We therefore take into account discounts (voucher codes) and wrapping costs in addition to the product price:

![]()

![]()

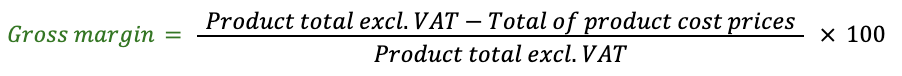

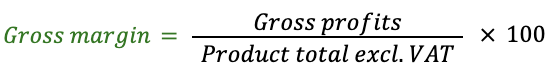

It's a percentage. This is the ratio of gross profits to total product amount:

It's a percentage. This is the ratio of net profits to the total amount of the sale:

E-mail of the customer who placed the order.

Last name of the customer who placed the order.

First name of the customer who placed the order.

Value of the "Company" field if entered by the customer in the invoice address.

Other FAQs in this category

- How to use the "Customers" report?

- How to use the "Products" and "Categories" reports?

- How to use the "VAT", "Profits and margins" and "Credit notes" reports?

- What do the columns in the "VAT on products" report correspond to?

- How to export the collected amounts by VAT rate?

- What do the columns in the "VAT" report correspond to?

- What do the columns in the "Product credit notes by VAT rate" report correspond to?

- What do the columns in the "Shipping credit notes" report correspond to?

- What do the columns in the "Credit notes" report correspond to?

- What do the columns in the "Customers" report correspond to?

- How to use the "Sales by country" report?

- What do the columns in the "Sales by country" report correspond to?

- How to use the "Brands" and "Suppliers" reports?

- What do the columns in the "Suppliers" report correspond to?

- What do the columns in the "Brands" report correspond to?

- What do the columns in the "Categories" report correspond to?

- What do the columns in the "Products" report correspond to?

- How to use the "Full" and "Basic" reports?

- What do the columns in the "Basic" report correspond to?

- What do the columns in the "Full" report correspond to?