How to use the "Sales by country" report?

This report allows you to export sales made in one or more countries, over a given period of time for example.

For details of the columns in this report, click here.

To learn how you can use this report to find out the amount of tax collected by country, follow the procedure below.

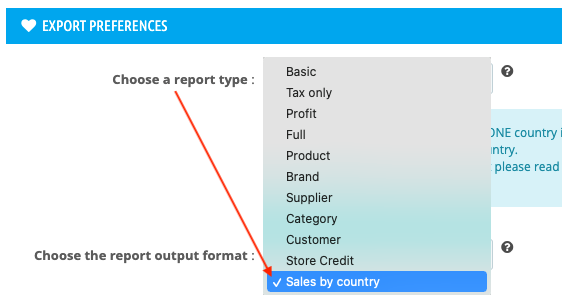

In the "Report configuration and export" tab, select the "Sales by country" report type:

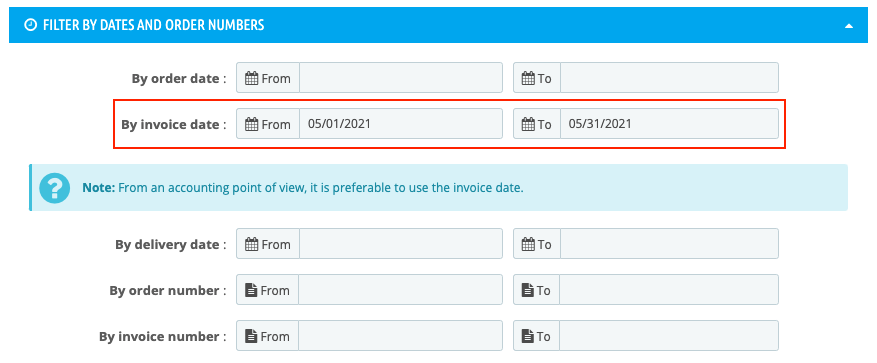

Choose the output format of your report (html or csv) and filter on a given period.

For example, here we have filtered by invoice dates, from 05/01/2021 to 05/31/21:

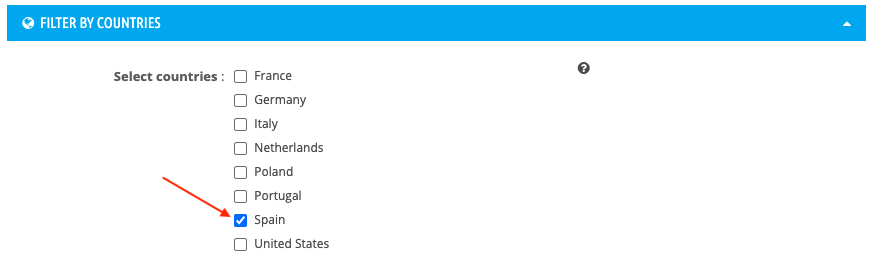

In the country filter section, select one or more countries from the list, for example "Spain" to see only sales in Spain:

If you want, select a field on which to sort and click on "Export".

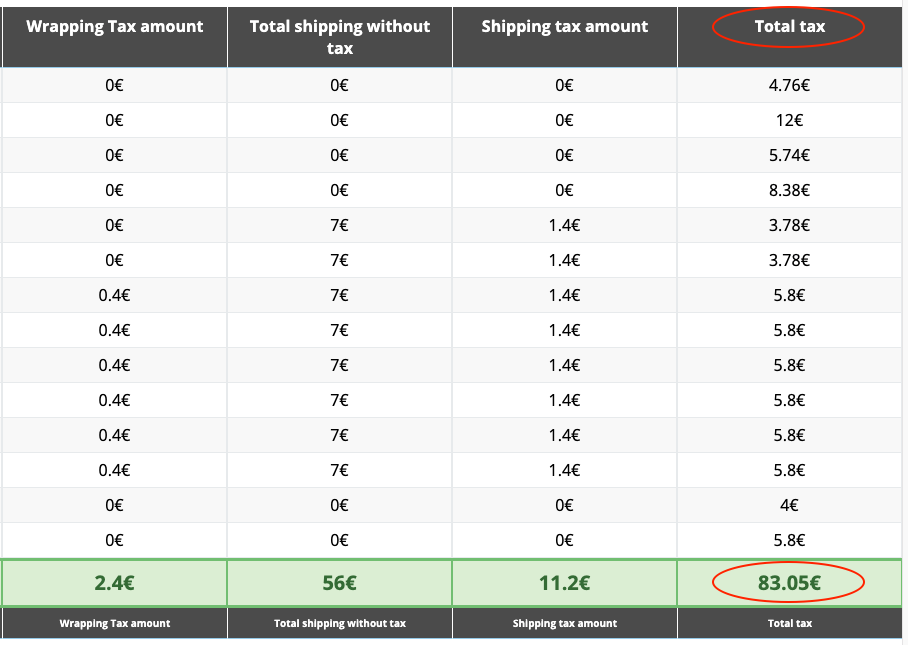

You get a table listing all the orders that took place in the selected country or countries. The column "Total tax" shows you (according to the tax rate set for each country in the configuration of your PrestaShop store) the total tax collected for each order and, at the bottom of the table, for all the orders displayed:

Note:

Since July 1st 2021, the VAT-e-commerce reform introduces new rules concerning the taxation of products sold remotly on the territory of the European Union. This "sales by country" report can be very useful for your VAT calculations by country. You can easily calculate the exact amount of taxes to pay to the corresponding states.

Important: check that the tax rates applicable in each country are well configured in your PrestaShop, otherwise, you will not have the right amount of tax collected. The module is based on the tax indicated in your PrestaShop, according to the country, at the time of the order. On the other hand, if the previous configuration is correct, the tax rate is the one of the destination country, whatever the amount of orders made in this country.

Other FAQs in this category

- How to use the "Customers" report?

- How to use the "Products" and "Categories" reports?

- How to use the "VAT", "Profits and margins" and "Credit notes" reports?

- What do the columns in the "VAT on products" report correspond to?

- How to export the collected amounts by VAT rate?

- What do the columns in the "VAT" report correspond to?

- What do the columns in the "Profits and margins" report correspond to?

- What do the columns in the "Product credit notes by VAT rate" report correspond to?

- What do the columns in the "Shipping credit notes" report correspond to?

- What do the columns in the "Credit notes" report correspond to?

- What do the columns in the "Customers" report correspond to?

- What do the columns in the "Sales by country" report correspond to?

- How to use the "Brands" and "Suppliers" reports?

- What do the columns in the "Suppliers" report correspond to?

- What do the columns in the "Brands" report correspond to?

- What do the columns in the "Categories" report correspond to?

- What do the columns in the "Products" report correspond to?

- How to use the "Full" and "Basic" reports?

- What do the columns in the "Basic" report correspond to?

- What do the columns in the "Full" report correspond to?