What do the columns in the "VAT on products" report correspond to?

In this FAQ we explain the meaning of each of the columns you'll find in the VAT report. To know how to export the collected amounts by VAT rate, go to this FAQ, and if you want to find out more about how to use reports of "VAT" type, go to this FAQ (videos are a bit old, so the column labels have changed a bit, but the principle remains the same!).

Name of the shop where the order was placed.

Name of the product or product combination (if you decide to display details by combination).

Note: if it's a product with combinations, but you don't display the details by combination, the column will display the default combination name.

Identifier of the product or product combination (if you choose to display details by combination).

VAT rate associated with the product (in percent).

Order identifier.

Order status at the time of report generation

Invoice number associated with the order.

Reference of the product or product combination (if you decide to display details by combination).

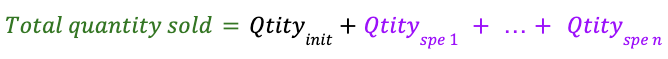

Quantity of this product (or product combination) sold over the selected period.

where:

Qtityinit is the quantity sold at the initial price

Qtityspe 1 is the quantity sold at the specific price 1

Qtityspe n is the quantity sold at the specific price n

Discount total excl. VAT (negative value)

Total amount of discounts applied using voucher code(s) (cart rules).

Please note: this column only calculates discounts resulting from voucher codes (cart rules). Discounts due to specific prices are not taken into account here.

Total VAT on discounts (negative value)

Total VAT associated with the total amount of discounts (cart rules), and which will therefore not be collected and paid to the government.

Total amount of the product (or product combination if you decide to display details by combination), over the selected period, excluding VAT.

If a specific price was applied when the order was placed, it is taken into account. In this sum we also take the eco-tax into account, if the product is concerned, excluding VAT.

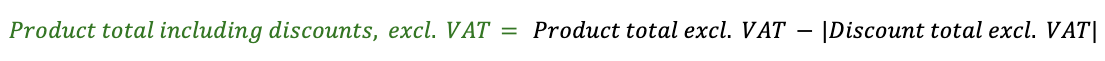

Product total including discounts, excl. VAT

This is Product total excl. VAT (see previous section) minus the sum of discount amounts (voucher codes), i.e. the absolute value of Discount total excl. VAT (see relevant section):

Please note: when we talk about discounts here, we're talking about discounts resulting from voucher codes (cart rules). Discounts due to specific prices have already been taken into account in the Product total excl. VAT.

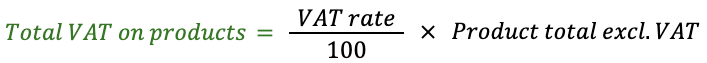

Sum of VAT collected on the product or product combination (if you decide to display details by combination):

Note: Total product excl. VAT includes specific prices (see previous section). It also includes the total amount of eco-tax if the product (or the product combination if you decide to display the detail by combination) is concerned, excluding VAT. In other words, the Total VAT on products includes the Total VAT on eco-tax, if any.

Total VAT is Total VAT on products minus the sum of VAT on discounts (voucher codes), i.e. the absolute value of Total VAT on discounts (see relevant section):

![]()

Other FAQs in this category

- How to use the "Customers" report?

- How to use the "Products" and "Categories" reports?

- How to use the "VAT", "Profits and margins" and "Credit notes" reports?

- How to export the collected amounts by VAT rate?

- What do the columns in the "VAT" report correspond to?

- What do the columns in the "Profits and margins" report correspond to?

- What do the columns in the "Product credit notes by VAT rate" report correspond to?

- What do the columns in the "Shipping credit notes" report correspond to?

- What do the columns in the "Credit notes" report correspond to?

- What do the columns in the "Customers" report correspond to?

- How to use the "Sales by country" report?

- What do the columns in the "Sales by country" report correspond to?

- How to use the "Brands" and "Suppliers" reports?

- What do the columns in the "Suppliers" report correspond to?

- What do the columns in the "Brands" report correspond to?

- What do the columns in the "Categories" report correspond to?

- What do the columns in the "Products" report correspond to?

- How to use the "Full" and "Basic" reports?

- What do the columns in the "Basic" report correspond to?

- What do the columns in the "Full" report correspond to?